The Ag Economists’ Monthly Monitor survey is a joint effort between Farm Journal and agricultural policy research centers at the University of Missouri. Questions are sent to agricultural economists nationwide to gauge perspectives on important drivers of agriculture and provide unique and timely insights that affect stakeholders at all levels of the industry with the results being posted on Ag Web.

Participants in the Monthly Monitor survey are carefully selected to represent both academic and industry perspectives from across the United States. The first of its kind, the survey harvests insight from individuals with expertise in crop, livestock, policy and agricultural finance. The economists provide insights into agricultural economic health and views on market trends through crop and livestock production forecasts, farm income expectations, as well as pre-USDA report estimates. The survey is anonymous, a key factor what makes this survey so valuable.

Participants in the Monthly Monitor survey are carefully selected to represent both academic and industry perspectives from across the United States. The first of its kind, the survey harvests insight from individuals with expertise in crop, livestock, policy and agricultural finance. The economists provide insights into agricultural economic health and views on market trends through crop and livestock production forecasts, farm income expectations, as well as pre-USDA report estimates. The survey is anonymous, a key factor what makes this survey so valuable.

The Ag Economists’ Monthly Monitor is a survey of nationally recognized economists representing multiple universities, commodity groups and private organizations and companies spanning multiple geographic regions. This diversity allows for expertise in a variety of crop, livestock and policy sectors.

The Rural and Farm Finance Policy Analysis Center (RaFF) and the Food and Agricultural Policy Research Institute (FAPRI) at the University of Missouri support the Ag Economists’ Monthly Monitor survey as it provides farms, ranches and agribusinesses a glimpse into expert economist opinion on the current and future states of agricultural markets, domestically and abroad. RaFF and FAPRI team members are enthusiastic about the future of the Ag Economists’ Monthly Monitor and the opportunity the survey affords for economists of varying expertise to share their views with a broader audience.

Economists were asked their biggest concerns regarding the outlook of U.S. agriculture. The responses varied based on crops and livestock, but in general, the Monthly Monitor revealed the biggest concerns include:

• Increased input prices

• Abnormal weather patterns (including drought)

• Export demand and geopolitical risks

• Margin squeeze for producers

• Increased interest rates

• Regulatory pressures negative impact on demand.

To view more in-depth coverage from the first Monthly Monitor, visit AgWeb.com

The Ag Economy Is Healthy, And That’s One Reason Economists Think It Could Be 2025 Before We See A New Farm Bill

Ag Economists Turn More Bullish On Soybean Prices, Corn Prices Are a Big Red Flag

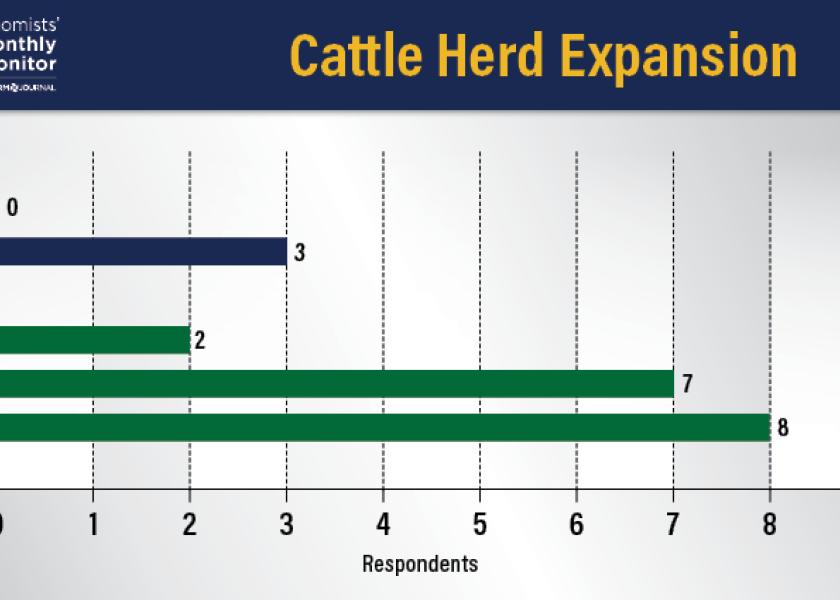

Could Cattle Prices Soar Through Next Year? That’s What Economists Think, And It Could Completely Change the Industry

Tyne Morgan talks with University of Missouri Agricultural Economist, Scott Brown about the findings of the first Ag Economists’ Monthly Monitor Reports